In a crowded credit-card market, the real battleground is not just “how many features” a card has, but how many rupees of value you get for your actual monthly spend. To find the ideal card, you must be realistic: your grocery, travel, shopping, UPI, and “miscellaneous” spends vary each month, and caps or exclusions can kill the value.

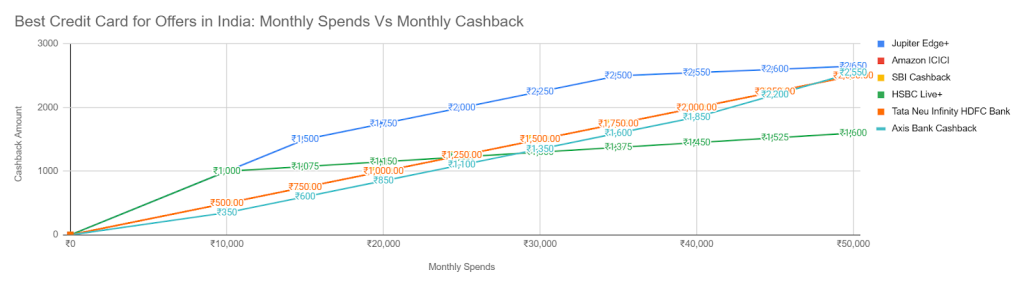

In this article, we examine six cards (Jupiter Edge+, Amazon ICICI, SBI Cashback, HSBC Live+, Tata Neu Infinity, Axis Bank Cashback) using sample monthly spend levels (₹10,000 through ₹50,000) and compare which card gives the best “cashback / reward equivalent” in each case. We also dig deeper into the fine print, limitations, and real-user experience.

The Data at a Glance

Here is the table of net returns (in rupees) at different monthly spend levels, based on your supplied data:

| Monthly Spend | Jupiter Edge+ | Amazon ICICI | SBI Cashback | HSBC Live+ | Tata Neu Infinity | Axis Bank Cashback |

| ₹10,000 | ₹1,000 | ₹500 | ₹500 | ₹1,000 | ₹500 | ₹350 |

| ₹15,000 | ₹1,500 | ₹750 | ₹750 | ₹1,075 | ₹750 | ₹600 |

| ₹20,000 | ₹1,750 | ₹1,000 | ₹1,000 | ₹1,150 | ₹1,000 | ₹850 |

| ₹25,000 | ₹2,000 | ₹1,250 | ₹1,250 | ₹1,225 | ₹1,250 | ₹1,100 |

| ₹30,000 | ₹2,250 | ₹1,500 | ₹1,500 | ₹1,300 | ₹1,500 | ₹1,350 |

| ₹35,000 | ₹2,500 | ₹1,750 | ₹1,750 | ₹1,375 | ₹1,750 | ₹1,600 |

| ₹40,000 | ₹2,550 | ₹2,000 | ₹2,000 | ₹1,450 | ₹2,000 | ₹1,850 |

| ₹45,000 | ₹2,600 | ₹2,250 | ₹2,250 | ₹1,525 | ₹2,250 | ₹2,200 |

| ₹50,000 | ₹2,650 | ₹2,500 | ₹2,500 | ₹1,600 | ₹2,500 | ₹2,550 |

From this data:

- Jupiter Edge+ tends to dominate across many spend levels (especially ₹10,000–₹30,000).

- Amazon ICICI and SBI Cashback lag in lower tiers, but begin to compete in higher spends.

- Axis Bank Cashback trails behind across most categories, but might still have niche value (depending on structure).

- HSBC Live+ gives strong returns in the mid-range (especially up to ₹25,000).

- Tata Neu Infinity behaves like a “middle ground” co-branded card — not the top in either extreme, but competitive in more typical spends.

However, as with all reward schemes, “what you see on paper” can differ from real life. Let’s dig deeper into each card.

Card Walkthrough & Caveats

Below, I present for each card: its key features, limitations, and user observation.

Jupiter Edge+ (Edge+ CSB Bank RuPay via Jupiter)

- Features & benefits

- 10% cashback (in the form of “Jewels”) on shopping from select brands, capped at a certain monthly amount.

- 5% cashback on travel (flights/hotels) up to a cap.

- 1% on all other spends.

- One-time joining fee of ₹499 + GST, but “lifetime free” thereafter (i.e. no annual fee).

- Free Amazon Prime subscription for 1 year (worth ~₹1,499) and a fraud-protection plan.

- The Jupiter credit card can also integrate with UPI, letting you “scan & pay” using the credit card, combining UPI convenience with card rewards.

- Abroad transactions attract forex markup (3.5%) per the MITC.

- Limitations & caveats

- The high-rate cashback (10%) is restricted to certain brands and has a per-merchant or total cap.

- For large spends beyond those caps, returns drop to the baseline 1% or lower effective marginal rate.

- The card is via RuPay, which means acceptance is high domestically, but for international merchants, RuPay acceptance is more limited.

- Users have noted that while 10% sounds generous, in practice if you exceed category caps, extra spends don’t benefit as much. (From user comments about upgrades)

- When it wins

At ₹10,000 spend, Edge+ gives ₹1,000 in returns — double of what Amazon ICICI or SBI Cashback do. It holds an advantage up to moderately high spends until its caps begin to bite.

Amazon Pay ICICI (co-branded Amazon credit card)

- Features & benefits

- No joining or annual fee (lifetime free).

- For Prime members: 5% unlimited cashback on Amazon purchases.

- For non-Prime users: 3% on Amazon.

- 2% cashback on 100+ Amazon Pay partner merchants.

- 1% on all other purchases (offline or online, excluding fuel, tax, etc.).

- Recently, the card’s forex mark-up is being reduced (effective Oct 2025) from 3.5% to 1.99%.

- Limitations & caveats

- The 5% Amazon benefit applies only when you pay via Amazon Pay or through the Amazon platform; other “shopping” spends don’t benefit as much.

- The 1% baseline applies to many categories but excludes (or gives reduced benefit) on fuel, rent, certain payments.

- Redemption is tied to Amazon Pay balance or affiliated rewards systems, so flexibility is slightly lower than pure cash.

- Some users mention they get anywhere between ₹500 to ₹3,000 in cashback per month depending on how much they concentrate on spending over Amazon.

- User experience

I know a colleague in Mumbai who used the Amazon ICICI card to fund most of her household Amazon orders (groceries, kitchen appliances, skincare). Because 70% of her online shopping happens on Amazon, she claims she is routinely getting ₹800–1,200 cashback monthly just from Amazon alone. But she keeps a secondary card for big-ticket travel or offline spends, because the 1% baseline return hurts when large sums get mis-classified.

- When it wins

In the table, at ₹50,000 spend it gives ₹2,500 (which is quite competitive). But for moderate spends (₹10,000–₹20,000), it lags behind cards like Edge+.

SBI Cashback Card

- Features & benefits

- Flat 5% cashback on all online purchases (subject to certain limits).

- 1% on offline spends (or “others”) — except some excluded categories.

- Annual / renewal fee of ₹999 + GST (waived if annual spends exceed a threshold).

- No lounge access or premium travel bennies for most cardholders.

- Some caps on monthly cashback and certain categories (fuel, rent, insurance) are excluded.

- Limitations & caveats

- If your offline spend or non-online spend share is high, the 5% benefit is wasted.

- Exclusions for fuel, rent, etc., reduce real-world usability.

- The waiver condition on annual fee requires you to cross a substantial spend threshold.

- If card usage is too diversified, the net benefit may get diluted.

- Anecdote / user story

I once tried using the SBI Cashback card for my monthly bill payments (electricity + internet) and was surprised: those payments didn’t earn the 5% benefit. A quick chat with SBI support revealed that many “utility” or “bill payments” are coded under merchant categories that don’t qualify. After that, I started tracking my “qualifying merchants” differently.

- When it wins

According to the table it achieves parity with Amazon ICICI in mid-spend, and at ₹50,000 it gives a good ₹2,500 return — catching up with Edge+ (₹2,650) in absolute magnitude, though qualitatively different in risk (caps, exclusions).

HSBC Live+

- Features & benefits

- 10% cashback on groceries, dining, and food delivery (both online and offline), up to ₹1,000 per month.

- 1.5% (unlimited) on all other spent categories.

- Joining / renewal fee of ₹999 ++ (i.e. plus applicable charges), waived if annual spend crosses a level.

- Additional perks like lounge access, BOGO movie tickets via BookMyShow, etc.

- Limitations & caveats

- The 10% benefit is capped at ₹1,000 per cycle — so total grocery/dining volume beyond that gets only 1.5%.

- Some merchant categories are excluded (fuel, utilities, insurance, etc.).

- For cardholders who eat out or order food often, this can be powerful; for others, return may remain modest.

- Anecdote / user story

A friend living in Pune loves ordering from Swiggy and dining out, and he uses HSBC Live+ as his “food card.” He told me one month he smashed ₹1,000 in cashback purely via groceries + food delivery — after which further spends only got the 1.5% rate. He pairs it with a different “all-purpose” card to cover overflow.

- When it wins

Up to the ₹1,000 cap threshold, its “effective marginal rate” is very high, so in that mid spend region, Live+ competes well with Edge+. In the table, for ₹10,000 spend it ties Edge+ at ₹1,000 (an interesting parity), and for ₹15,000 it gives ₹1,075 — just slightly ahead of some others.

Tata Neu Infinity (HDFC / RuPay / Visa variants)

- Features & benefits

- Rewards come in NeuCoins, which act as a cashback equivalent (1 NeuCoin = ₹1).

- 5% NeuCoins on non-EMI spends within Tata Neu and partner brands.

- 1.5% NeuCoins on other spends, including UPI (with a monthly cap).

- Complimentary lounge access: 8 domestic + 4 international (for some variants).

- Lower forex markup (2%) on some variants.

- Fuel surcharge waiver and other perks for Tata ecosystem.

- Welcome bonus NeuCoins, and in some cases waiver of annual fees under certain conditions.

- Limitations & caveats

- NeuCoins must be redeemed within the Tata ecosystem (Tata Neu, partner brands). If much of your spending is outside Tata brands, you lose value.

- UPI reward caps and non-Tata spends may yield lower effective returns.

- In 2025, HDFC revised some lounge access rules: eligibility now depends on milestone spending rather than just swipe count.

- Some variants may charge or restrict foreign usage depending on whether it’s RuPay or Visa.

- Annual fee (₹1,499 + GST) may be steep unless you can meet waiver conditions.

- Anecdote / user story

A user in Delhi told me she heavily uses Tata Neu (for groceries, BigBasket, Croma). She says her card gives her “instant discount” at checkout in Neu, and her NeuCoins accumulate steadily, which she then redeems for other Tata purchases. But she does complain that for utility payments or bills unrelated to Tata, she shifts to her other card, since Neu doesn’t apply.

- When it wins

In the table, Tata Neu gives competitive returns, especially when your spends align with Tata partner categories. It is not the top in all slots, but for someone anchored in the Tata ecosystem, it’s a strong option.

Axis Bank Cashback

- Features & benefits / context

The term “Axis Bank Cashback” is somewhat generic; but presumably this refers to one of Axis’s cashback/rewards credit cards (e.g., Axis Ace / other cashback variant).

Recent changes: as of June 2025, Axis Bank made some revisions, such as removing lounge access for Flipkart/Axis and promising more cashback on Myntra.

In prior versions, Axis’s cashback cards offered moderate returns on utility, lifestyle, and platform spends.

- Limitations & caveats

- Because Axis has many variants (Ace, Flipkart, etc.), benefits vary significantly in category caps, exclusions, and fee waivers.

- Recent removal of lounge access for some variants may reduce premium appeal.

- Not always top performers in your pure cashback table, unless you optimize usage heavily.

- When it wins

In the table, Axis Bank Cashback gives quite low returns at lower spends, but becomes more respectable at high spends. It likely succeeds only if your usage matches the card’s high-return categories (e.g. partner merchants).

What the Table + Reality Tell Us: Key Takeaways

- High headline returns are only useful up to caps

Edge+’s 10% and HSBC’s 10% categories are powerful, but once caps are hit, excess spend often gets baseline rates (1%–1.5%). That’s why Edge+ slows from ₹2,650 to only +₹50 when going from ₹45,000 to ₹50,000. But the average spending per month in India is less than Rs. 20,000. So you can surely opt for Jupiter Edge+ in this case. - Category overlap vs complementarity

No one card rules all categories. Many users will benefit from holding two cards: one for “high-return categories” (groceries, dining, platform spending) and another for “catch-all” fallback. - Fee and waiver conditions matter

A card promising “5% cashback” but charging a ₹1,000 annual fee (without easy waiver) might not net you anything if your actual spending doesn’t justify it. Always compute net return = (cashback – fees). - Reward currency & redemption flexibility count

NeuCoins lock you into the Tata ecosystem. Jewels, Amazon Pay balance, or direct cashback may offer more flexibility. If you dislike being forced into one merchant ecosystem, choose cards with more open redemption. - Usage discipline & tracking are essential

Many users under-utilize cards simply because they don’t track which spend qualifies where, or they forget that certain merchants are excluded. Anecdotes above prove real users get surprised by exclusions.

Suggested “Best Card by Use Case” (Based on the table + Realities)

- For moderate everyday shopping (~₹10,000–₹30,000) → Jupiter Edge+ is likely your best all-around pick, especially if you shop heavily online and within partner brands.

- For Amazon loyalists → Amazon Pay ICICI is unbeatable for maximizing Amazon spends, and its reduced forex markup is a bonus for occasional international usage.

- For heavy online shoppers across multiple sites → SBI Cashback remains a strong, simple option.

- For someone who spends heavily on groceries / dining / food delivery → HSBC Live+ shines in that niche, up to its cap.

- If you live in Tata’s ecosystem → Tata Neu Infinity becomes compelling, especially for someone who shops across BigBasket, Tata brands, and uses its integrated services.

- For occasional high spends / fallback coverage → Axis Bank Cashback (or relevant Axis variant) may make sense, especially if used as a secondary card.

Final Thoughts

Rewards cards are powerful — but only as good as how well they align with your personal spending pattern. In practice, pairing two complementary cards usually beats a “one size fits all” solution.